Source: securityboulevard.com – Author: mykola myroniuk

Organizations handling payment data face a critical deadline: achieving PCI DSS 4.0 certification by March 31, 2025. The solution is simple: use automated security tools like Feroot PaymentGuard. This helps meet regulations, reduce risks, and protect payment environments.

The Problem: New Client-Side Security Requirements

PCI DSS v4.0 introduces critical requirements that many organizations struggle to implement:

Requirement 6.4.3 demands automated verification of client-side script integrity—traditional manual approaches no longer suffice.

Requirement 11.6.1 requires implementing browser security controls to protect payment data from sophisticated client-side attacks.

Organizations face several implementation challenges:

- Continuous monitoring across multiple payment pages

- Managing dozens of third-party scripts

- Detecting unauthorized script changes in real-time

- Documenting compliance for auditors

- Preventing client-side data exfiltration

The Solution: Feroot PaymentGuard’s Automated Approach

Feroot PaymentGuard provides ready-to-implement solutions for immediate compliance:

For Requirement 6.4.3 (Script Integrity)

- Automated Script Inventory: Creates and maintains a complete catalog of all scripts on payment pages

- Continuous Integrity Monitoring: Automatically verifies script integrity 24/7

- Change Detection: Alerts security teams to unauthorized modifications within seconds

- Audit-Ready Documentation: Generates compliance evidence automatically

For Requirement 11.6.1 (Browser Security Controls)

- One-Click CSP Implementation: Deploys Content Security Policies with minimal configuration

- Form Field Protection: Prevents unauthorized access to payment form fields

- Automated Security Headers: Implements and manages all required security headers

- Third-Party Control: Manages and restricts third-party script execution

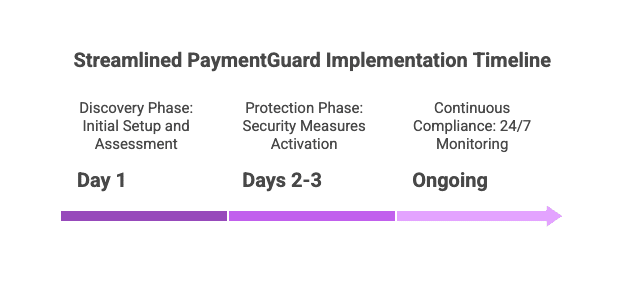

Implementation Process: Three Simple Steps

PaymentGuard implementation follows a straightforward process:

- Discovery (Day 1):

- Deploy lightweight tag to payment pages

- Automatic script inventory creation

- Baseline script integrity assessment

- Protection (Days 2-3):

- Automated security policies deployment

- Form field protection implementation

- Data exfiltration controls activation

- Continuous Compliance (Ongoing):

- 24/7 script integrity verification

- Automated alerts for unauthorized changes

- Continuous compliance documentation

Real Solution Results

Organizations using Feroot PaymentGuard report specific, measurable benefits:

- Time Savings: 95% reduction in compliance implementation time

- Resource Efficiency: Automation eliminates the need for additional security personnel

- Comprehensive Protection: Complete coverage of all payment pages and scripts

- Audit Readiness: Auto-generated documentation satisfies even the strictest QSAs

- Risk Reduction: Early detection of script tampering attempts before data theft occurs

Case Example: E-commerce Platform Solves Compliance Challenges

A mid-size e-commerce company with 50+ payment pages faced significant challenges meeting requirements 6.4.3 and 11.6.1:

Before PaymentGuard:

- Manual script inventory was incomplete and quickly outdated

- No real-time change detection capabilities

- Limited visibility into third-party script behavior

- Unable to verify script integrity consistently

After Implementing PaymentGuard:

- Complete script inventory created automatically

- Unauthorized script modifications detected in real-time

- Automated CSP implementation across all payment pages

- Compliance documentation generated automatically

- Full requirements 6.4.3 and 11.6.1 compliance achieved in one week

Implementation Timeline: Beat the March 31, 2025 Deadline

Organizations can achieve full compliance with requirements 6.4.3 and 11.6.1 on the following timeline:

- Week 1: PaymentGuard deployment and initial configuration

- Week 2: Security policy tuning and documentation generation

- Week 3: Final validation and compliance verification

- Ongoing: Continuous compliance monitoring and documentation

This streamlined timeline ensures complete compliance well ahead of the March 31, 2025 deadline, eliminating last-minute rush and potential penalties.

Solution Comparison: PaymentGuard vs. Traditional Approaches

| Compliance Need | Manual Approach | Traditional Security Tools | Feroot PaymentGuard |

|---|---|---|---|

| Script Inventory | Labor-intensive, error-prone | Incomplete, point-in-time | Automated, continuous |

| Change Detection | Manual reviews, delayed | Limited detection capabilities | Real-time, comprehensive |

| CSP Implementation | Complex, resource-intensive | Generic, not payment-focused | Automated, payment-specific |

| Documentation | Manual collection, spreadsheets | Limited automation | Fully automated, audit-ready |

| Implementation Time | Months | Weeks | Days |

Next Steps: Implementing Your Compliance Solution

Don’t wait until the last minute to address PCI DSS v4.0 requirements 6.4.3 and 11.6.1. Feroot PaymentGuard offers a proven solution that can be implemented quickly with minimal resources:

- Schedule a solution demonstration to see PaymentGuard in action

- Request a compliance readiness assessment for your payment environment

- Develop an implementation plan based on your specific needs

- Deploy PaymentGuard with Feroot’s implementation team

With Feroot PaymentGuard, you can transform PCI DSS v4.0 compliance from a complex challenge to a solved problem, well ahead of the March 31, 2025 deadline.

Original Post URL: https://securityboulevard.com/2025/03/pci-dss-4-0-achieve-compliance-with-feroot-before-march-31/?utm_source=rss&utm_medium=rss&utm_campaign=pci-dss-4-0-achieve-compliance-with-feroot-before-march-31

Category & Tags: Security Bloggers Network,pci dss compliance – Security Bloggers Network,pci dss compliance

Views: 7