Source: securityboulevard.com – Author: DataDome

If you sell anything online or store any sensitive information digitally, you’re at risk of fraud. Online payment fraud losses doubled from 2021 to 2022, and three quarters of online merchants reported an increase in fraud attacks since the start of the pandemic. You have to protect yourself, and fraud monitoring lies at the heart of digital protection.

Fraud monitoring is the systematic and continuous process of observing activities to detect and prevent fraud. Advanced fraud monitoring is meant to shield businesses from ever-evolving fraud techniques that can easily bypass more traditional defense systems. In this article, we discuss what advanced fraud monitoring and detection methods exist, what role AI in fraud detection plays, and what features world-class online fraud protection software should have.

The Role of Continuous and Risk-Based Monitoring in Uncovering Fraud

In order to effectively detect fraud, you need both continuous and risk-based monitoring. Continuous monitoring refers to the non-stop, automated surveillance of online activities on your websites, mobile apps, and APIs. Unlike periodic checks, this method offers real-time insights to ensure that any suspicious activity is flagged immediately.

Risk-based monitoring means focusing one’s attention where it matters most. For example, when it comes to transaction fraud detection, risk-based monitoring means prioritizing high-risk transactions as determined by transaction value, location, behavioral patterns, et cetera. This method ensures that resources are used efficiently and threats are detected and dealt with based on their potential impact.

When combined, continuous and risk-based monitoring offer a layered defense against fraud. While the former ensures uninterrupted surveillance, the latter ensures that high-priority threats are addressed first. These twin strategies ensure that you remain both proactive and reactive, ready to counter any threat that comes your way.

Understanding Advanced Fraud Detection Methods

Advanced fraud monitoring is important because traditional techniques are falling short. Savvy fraudsters and hackers armed with modern tools and techniques no longer struggle with traditional fraud detection and prevention methods because of the following reasons:

- Reliance on Static Rules: Traditional fraud detection methods rely heavily on static rules and predefined thresholds. Although effective in the past, such methods are now easily bypassed.

- High False Positives: Static rules often mistakenly flag legitimate transactions as fraudulent, leading to unnecessary investigations and potentially alienating genuine customers.

- Lack of Adaptability: Traditional fraud detection methods quickly grow outdated as fraud tactics evolve. What may work one year won’t work the next year.

- Inefficiency: Because of its static, inflexible rules, companies often spend a lot of time adjusting thresholds and rules, making fraud protection tedious and less efficient.

In comparison to traditional fraud detection methods, advanced fraud monitoring relies on the following techniques to block even the most advanced, newest fraud threats.

Machine Learning in Fraud Detection

Machine learning in fraud detection is a crucial aspect of advanced fraud monitoring. Machine learning (ML) means that algorithms can learn from historical transaction data and adjust their behavior over time. It’s a dynamic approach that minimizes false positives and adapts to ever-evolving fraud techniques.

Anomaly Detection

Instead of relying on predefined rules, advanced fraud monitoring software identifies anomalies that don’t conform to expected behavior. This is crucial for pinpointing new fraud tactics that the software may never have encountered before. By learning and updating its standards, it can protect you against the latest fraud threats.

Behavior Analysis

Human behavior is intricate and unique. Behavior analysis in advanced fraud detection examines user patterns by looking at purchasing habits, device usage, login patterns, and more. By understanding a user’s default behavior, it becomes easier to spot unusual behavior that could indicate fraud.

Proactive Fraud Prevention Strategies and Frameworks

To win the battle against fraud, first you have to detect it. Then you have to prevent it. By proactively identifying and stopping potential threats, you significantly reduce the severe reputational, legal, and financial risks of fraud. Let’s explore some proactive prevention strategies and how they can be implemented into robust fraud prevention frameworks.

Data Analysis for Fraud Prevention

Data is your most potent weapon against fraud. By rigorously analyzing transaction data, user behavior, and historical trends, you can identify potential vulnerabilities in your defenses—and shore them up before they’re exploited.

For example, Seattle Coffee’s e-commerce store was regularly hit by carding attacks. Their mitigation efforts were manual and time-consuming. During their trial of the DataDome solution, our credit card fraud monitoring immediately detected malicious bots that the previous solution had missed. Today, Seattle Coffee’s online store no longer suffers from frustrating slowdowns and excessive transaction costs.

Predictive Modeling to Forecast Fraud

Predictive modeling uses historical data to forecast potentially fraudulent activities. It can predict the likelihood of a transaction being fraudulent based on multiple variables like transaction amount, location, time, and previous behavior.

For example, KISS USA struggled with payment failures. They had no way to understand whether the failures were because of carding bots or just declined cards. Because of DataDome’s predictive modeling, malicious bots browsing the KISS USA website are now identified and blocked while genuine users are let through.

Risk Scoring to Evaluate Transaction Trustworthiness

Risk scoring is a method where each transaction is assigned a score based on its perceived threat level. Factors influencing this score include user behavior, transaction details, device information, and more. A high-risk score means a transaction is more likely to be fraudulent.

You can implement risk scoring by setting up algorithms that factor in various variables to assign a risk score. Over time, with continuous feedback, this scoring system can be refined for higher accuracy. Payment fraud protection software generally uses some kind of risk scoring to identify threats.

Benefits of Advanced Fraud Monitoring Software

Advanced fraud monitoring software is an investment into the future of your business. It presents you with benefits that extend beyond threat prevention. Here are some of the most prominent benefits:

High Accuracy in Detecting Sophisticated Fraud Patterns

Modern fraudsters use intricate and evolving techniques to defraud your business. Advanced fraud monitoring software is the best way to keep up, because such software continuously learns and adapts. Even the most covert fraudulent activities won’t slip through the cracks.

Fewer False Positives and Negatives

False alarms aren’t good for your business. They consume resources, alienate genuine customers, and divert attention from actual threats. Advanced software, by virtue of their algorithms, drastically reduces such false alarms. Transaction fraud detection means that genuine transactions are processed smoothly, while genuine threats are noticed and stopped.

Cost Savings and Improved Operational Efficiency

Efficient fraud monitoring software directly impacts the bottom line. By proactively detecting and preventing fraud, you can avoid financial, reputational, and legal damage. It also means fewer manual interventions and more time to spend on productive activities.

Leveraging Real-Time Monitoring for Fraud Prevention

Uninterrupted real-time monitoring is crucial for preventing fraud, because an unmonitored period of even a few minutes can be the difference between successful fraud prevention and significant loss.

Technologies and tools that enable real-time fraud monitoring include cloud-based systems that can run on any device, advanced analytics platforms that allow businesses to process massive streams of data in real-time, and integrated APIs that connect different platforms and tools so there are seamless data flows and instant alert mechanisms.

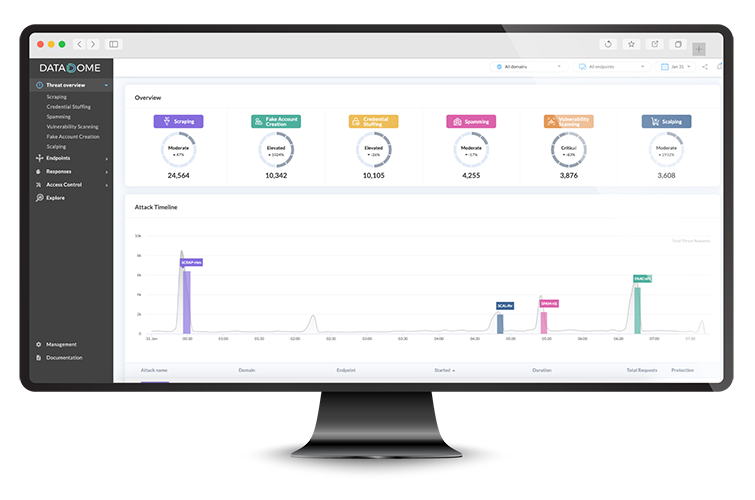

A view of the DataDome Real-Time Threat dashboard.

For example, when the French online insurance and service comparison platform Lesfurets implemented DataDome, they immediately noticed attacks on many different endpoints. DataDome blocked these attacks, improving the KPIs of Lesfurets as well as the reputation with their partners.

As another example, a major travel booking platform struggled with bots that were bypassing their CAPTCHAs. They decided to try out DataDome, which analyzed every single request to their websites, mobile apps, and APIs in real-time to block all malicious bots that were previously bypassing their defense setup.

Harnessing Automation & AI for Transaction Fraud Monitoring

Automation and artificial intelligence (AI) are revolutionizing fraud monitoring. Automation minimizes manual intervention and reduces the risk of human errors, while AI in fraud detection software improves its efficiency, accuracy, and overall effectiveness.

Examples of AI-driven technologies include neural networks designed to recognize patterns and make decisions based on vast amounts of data, natural language processing (NLP) to detect fraud in textual data like emails or user feedback, and deep learning to sift through multi-layered data sets and unearth intricate fraud patterns.

Advanced fraud protection software that combines real-time monitoring with automation and AI gives businesses a fighting chance against all kinds of fraud and automated threats without having to spend significant resources.

Top Features of a Fraud Monitoring Solution

When you’re in the market for a robust fraud monitoring solution, you need to look for something that can fully protect you while also being efficient and adaptable. This means you need to look for the following features:

- Real-Time Fraud Detection: Instantly flags suspicious activities, minimizing potential risks.

- AI-Powered Analysis: Adapts and learns from user patterns, offering nuanced detection capabilities.

- Granular Reporting: Offers detailed insights into fraud attempts and patterns to help with strategic decision-making.

- Behavior Analysis: Understands user behavior intricacies, differentiating between genuine users and bots or malicious entities.

- Multi-Layered Security: Offers various layers of protection, ensuring a holistic defense against multiple fraud types.

- Intuitive Dashboard: A user-friendly interface for at-a-glance insights and easy management.

- Seamless Integration: Easily integrates with other platforms and systems without disrupting existing workflows.

- Automated Alerts: Sends instant notifications when it detects any irregularities, while also taking immediate action.

Monitor Fraud in Real-Time with DataDome

DataDome is an advanced fraud protection solution that monitors and stops fraud in real-time. It identifies and tackles threats as they appear, blocking them within milliseconds. It does so by relying on AI and machine learning to always stay ahead of even the latest automated threats.

DataDome can protect all your endpoints, from your websites to your mobile apps to your APIs. It takes minutes to install, has many integrations so it easily fits within your existing digital architecture, and runs on autopilot. DataDome is a robust and multi-layered shield against automated threats and fraud. Try it out for yourself or book a live demo today.

FAQs

What is advanced fraud monitoring?

Advanced fraud monitoring is the process of monitoring and blocking suspicious activities that could lead to fraud. It relies on state-of-the-art techniques like AI, real-time detection, and behavior analysis.

Why is AI important in fraud detection?

AI adapts and learns from historical data, allowing for a more nuanced detection of evolving fraud patterns. It can predict emerging threats and reduce false alerts.

How does DataDome ensure seamless integration with my existing systems?

DataDome is a SaaS product that has dozens of integrations for your websites, mobile apps, and APIs. It is lightweight, takes only minutes to install, and requires no rejigging of your existing systems.

Can automation result in genuine transactions being flagged?

While no system is infallible, advanced fraud monitoring solutions like DataDome continuously refine their algorithms to minimize false positives, ensuring genuine transactions proceed smoothly.

How do behavior analysis and risk scoring help in fraud detection?

Behavior analysis understands the intricacies of user behavior, differentiating genuine users from potential threats. Risk scoring assigns a risk value to each user or transaction, allowing businesses to prioritize their responses.

What is the impact of fraud monitoring on user experience?

When properly implemented, fraud monitoring should be unobtrusive, to ensure that user experience isn’t compromised. Advanced systems like DataDome work in the background without affecting genuine users.

How frequently do I need to update or refine my fraud monitoring system?

With cloud-based, AI-powered solutions like DataDome, continuous updates and refinements are part of the package. This ensures that the system remains effective against evolving fraud techniques.

Is advanced fraud monitoring only necessary for large businesses?

No. Businesses of all sizes are targets for fraudsters. A robust fraud monitoring system is essential for any organization that conducts digital transactions or stores user data.

Original Post URL: https://securityboulevard.com/2024/02/guide-to-advanced-fraud-monitoring-proactive-detection-in-2024/

Category & Tags: Security Bloggers Network,learning center – Security Bloggers Network,learning center

Views: 3